PM Vishwakarma Scheme

The Bank is the implementing partner for several Government of India schemes, including the PM Vishwakarma Scheme, launched on September 17, 2023, to enhance the quality and reach of products and services by artisans and craftspeople. The scheme has received over 175 lakh applications within six months, with applications undergoing a three-stage verification process.

Production Linked Incentive (PLI) Schemes:

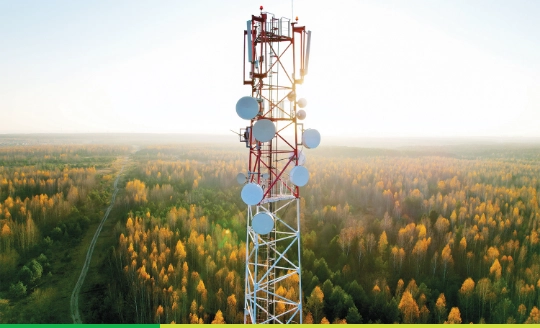

The Government of India launched Production Linked Incentive (PLI) Schemes to boost domestic manufacturing and encourage Make-in-India across various sectors. SIDBI is the Project Management Agency for the PLI Schemes for Pharmaceuticals and Telecom & Networking Products, both of which operate digitally, covering application processing, project monitoring, and incentive approvals. The total outlay is ₹15,000 crore for Pharmaceuticals and ₹12,195 crore for Telecom and Networking Products.

Under the Telecom and Networking Products scheme, 42 companies (28 MSMEs and 14 non-MSMEs) are approved, committing ₹4,014 crore in investment, expected to generate ₹2.37 lakh crore in additional sales and over 44,000 jobs. For the Pharmaceuticals scheme, 55 applicants, including 20 MSMEs, have been selected to receive incentives.

Scheme for Strengthening of Pharmaceuticals Industry – SPI:

The Department of Pharmaceuticals, Ministry of Chemicals and Fertilisers, launched the Scheme for Strengthening of Pharmaceuticals Industry (SPI) on July 21, 2022, to support pharmaceutical clusters and MSMEs in enhancing productivity, quality, and sustainability. The programme has a budget of ₹500 crore and includes three sub-schemes, with an online portal (https://spi.udyamimitra.in) managed by SIDBI for applications. In FY2024, grant assistance of ₹118 crore was sanctioned for six Common Facility Centres in pharma clusters across the country, with ₹44 crore released, including ₹23.75 crore in FY2024.

Animal Husbandry Infrastructure Development Fund (AHIDF)

A fund of ₹15,000 crore has been set up to encourage investments in establishing Dairy Processing & value addition infrastructure, Meat Processing & value addition infrastructure and Animal Feed Plants.

The Bank is partnering with the Department of Animal Husbandry & Dairying, MoFAHD, GoI to implement the scheme.

As on March 31, 2024, 5,500+ applications have been received on the portal and the applications amounting to ₹6,100+ crore have been sanctioned.

National Livestock Mission (NLM)

The Government of India, through the Department of Animal Husbandry & Dairying, is implementing the NLM scheme to increase animal productivity and production of various products. The government has engaged SIDBI as an implementing partner to monitor and process online applications in a transparent manner, as well as manage subsidies.

The online portal (https://nlm. udyamimitra.in) was launched by Hon'ble Union Minister, MOFAHD.

As on March 31, 2024, 763 applications have been approved and a total subsidy of 165.44 crore has been released to the beneficiaries.

Special Credit Linked Capital Subsidy Scheme (SCLCSS)

The Special Credit Linked Capital Subsidy Scheme (SCLCSS) was created in May 2017 as part of the National SC-ST Hub (NSSH) to help SC/ST-owned MSEs upgrade their technology by providing a 25% upfront capital subsidy for the purchase of plant and machinery and equipment through institutional credit. Since the launch of the Scheme, capital subsidy claims aggregating ₹159.51 crore to 1,320 units have been released through SIDBI. During FY 2023-24, claims aggregating ₹62.13 crore to 542 units have been released.